Large Companies and the economy

Life on the Farm

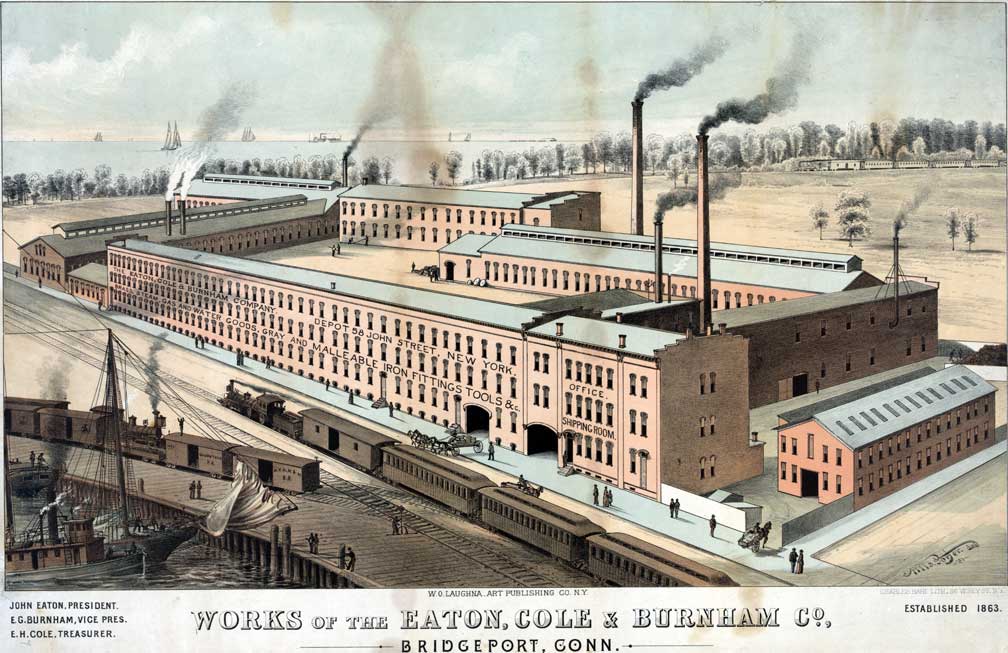

The second half of the 19th century was the period of the emergence of the large American corporation. The railroads were the first large companies. The very nature of the railroads required it to be large, with many levels of management. If railroads were to run with a minimum of accidents, it required precise organization and access to more information than other corporations generally had. Running a railroad demanded knowing the location of every train, at all times. Additionally, the railroads were the first large companies to raise much of its capital on the public markets. Thus, if on a typical day in the 1830s only dozens of trades took place on the New York Stock Exchange, by the 1850s — after the railroads discovered the Stockmarket— tens of thousands of shares were traded daily.

The public trading of company stock had another impact — i.e., for the first time, owners were not necessarily the managers. While the British and the Dutch had used stock companies, such as the East India Company to fund their exploration and trading of companies, that was not the case in American companies, at least not until the railroads came around. At this juncture, professional managers became the norm in growing American corporations. A few large companies grew to dominate their markets during this time period. It was a period where a number of individuals were able to dominate their markets and industries. Many those industrialists became known as the “Robber Barons” — i.e., people who became incredibly wealthy by dominating their markets. Some of the famous Robber Barons were John D Rockefeller(Oil), Andrew Carnegie(Steel) , John Astor(real estate and fur) James Pick (Finance) JP Morgan (Finance)