Ford McCum Tariff

-

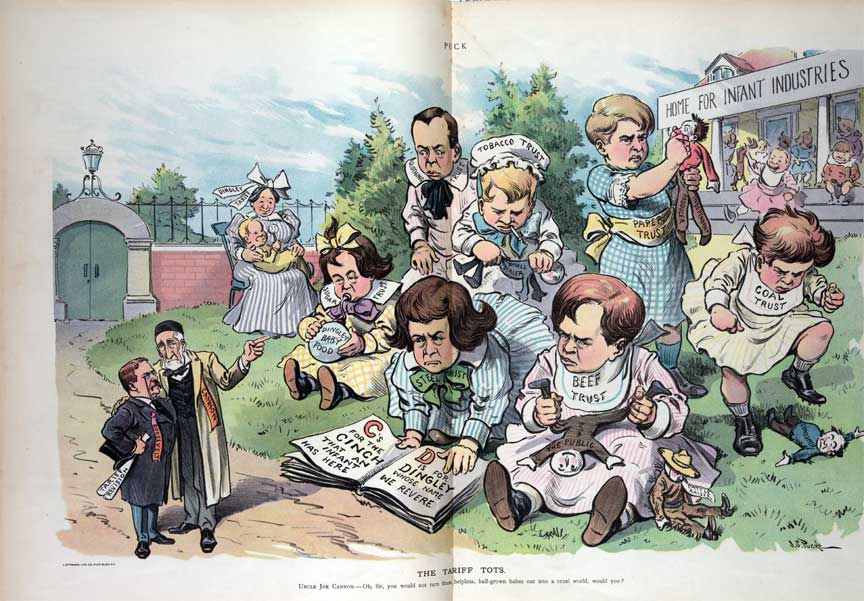

Illustration shows a group of children labeled "Sugar Trust (eating "Dingley Baby Food"), Clothing Trust, Tobacco Trust, Steel Trust, Beef Trust, Paper Trust, [and] Coal Trust", some are playing in a rough manner with little dolls labeled "Small dealer, The Public, Independent Producer, [and] Consumer", another doll, "Cattle Raiser" has been tossed aside. In the background, on the left, a woman labeled "Dingley Tariff" is sitting in a chair with a child on her lap, and on the right is a building identified as the "Home for Infant Industries". In the left foreground, Joseph Cannon is speaking to Theodore Roosevelt, who is holding a paper labeled "Tariff Revision".

This tariff was passed in 1922. It raised duties to an average of 38 percent. It particularly provided protection to thechemical and drug industries that had developed during World War I.

Both US industry and farming had flourished during World War I. The US was supplying the Allies with both arms and food. In 1919 farm production came to $17.7 Billion. Two years later production had dropped to $10.5 Billion, creating a depression on American farms. The fear was that drop would also happen to American Industry.

Once President Harding won his election Republicans quickly passed the Emergeny Tariff of 1921. The goal was to quickly raise tariffs to replace the low tariff in place under the Underwood Simmons Tariffs that the President Wilson had promoted. The new tariffs immediately increased tariffs on a large number of items including agricultural imports like wheat. The Emergency Tariff were passed as a stop gap matter until a more comprehensive tariff system could be put in place. The emergency tariff went into effect as soon as Harding took office and could sign the tariff.

The house held hearing on the best way to implement a tariff and decided on hat they called an American Valuation method. This was a system that calculate the American value of the product as opposed to the cost in the country of origin. Then a tariff of the difference would be placed on the goods. Most Democrats opposed the bill claiming it would just increase prices to Americans. The bill passed the House 289 to 127 on July 21, 1921

The Senate then took up the bill. They voted down the American Value method and instead gave the President the ability to raise the tariff on items based on his determination of value. The discussion on the bill in the Senate went on for a long time, but finally it passed the Senate 48 to 22 on August 19, 1922. The House and Senate then resolved their differences by agreeing to create a Tariff commission that would advice the President on what to set the tariffs at. In the end under the Fordney McCumber tariff the average duty on all imports was 14% as opposed to 9% under Underwood Simmons, and on duitable items it was 38.5% as opposed to the the duty of 27% under Underwood -Simmons. The average duty however was slightly lower then they had been under the 1909 Payne Aldrich duty.

>

>